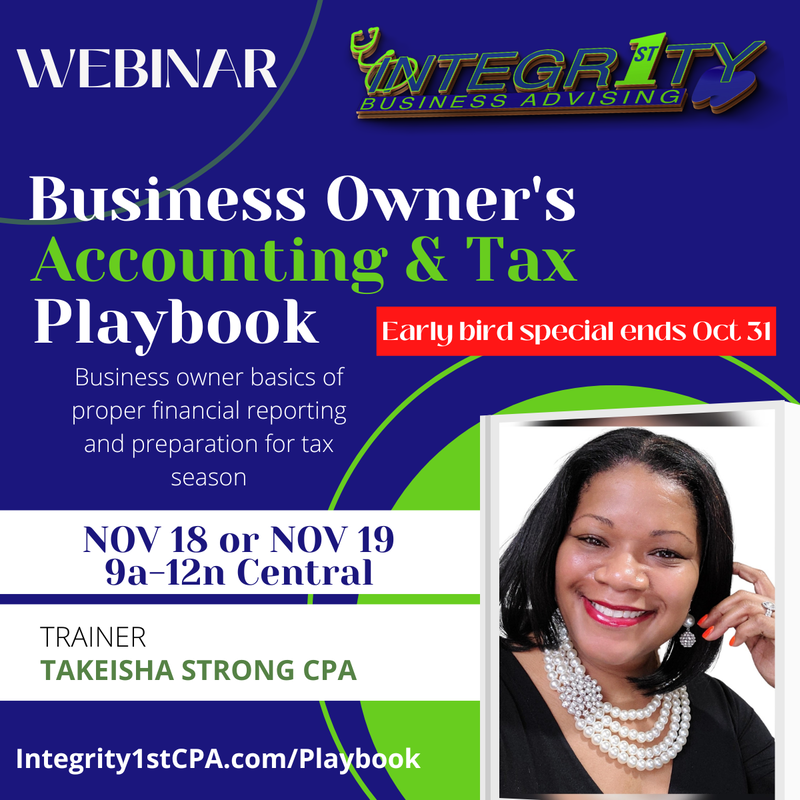

$399 Early Bird Special

(ends at midnight CT October 31, 2022)

$449 paid registration

Two dates available:

9a - 12n CT

Friday November 18

Saturday November 19

(ends at midnight CT October 31, 2022)

$449 paid registration

Two dates available:

9a - 12n CT

Friday November 18

Saturday November 19

- Has your business grown quicker than you expected?

- Have you been TRYING to handle preparing your business' financial statements on your own... just to end up frustrated and MORE confused?

- Has your tax professional suggested someone else take over the books for you?

- Are you a new entrepreneur and want to make sure you're doing things correctly from the start?

- Are you approaching the $1M or $2M gross revenue mark and want to make sure you can have a logical conversation with your accountant? Or... you know it's time you seek the services of one?

THIS WEBINAR IS FOR YOU!

Just in time to prepare for tax season, Takeisha Strong CPA, has put together a webinar geared towards new to mid-size business owners that desire a basic understanding of accounting AND plan to be adequately prepared for the 2023 tax filing season.

In this webinar, participants will learn:

In this webinar, participants will learn:

- The main financial statements and their layout

- How to create and customize the chart of accounts to mirror how the business operates (if you're saying my chart of what!?? - this webinar is for you!)

- Key financial statement terms

- How to prepare simple financial statements using Excel or QuickBooks Online, with hands on training from a CPA

- How to correctly classify common items such as mortgages and car notes and what is tax-deductible

- How to correctly classify items in QuickBooks Online, even when the bot suggests differently

- The purpose of depreciation and how it is used on financial statements and income tax returns

- Why reviewing your bank statement often is NOT the same as managing your business' finances

- Key questions to ask when hiring an accountant or tax professional

- A copy of the recorded webinar for future reference

- A list of FAQs and responses to reference after the training

Additional Details

This is a LIVE three-hour paid webinar via Zoom. The webinar will include live demonstrations of how to prepare financial statements using Excel and Intuit QuickBooks online. These products are not required for attendance and will be used for demonstrative purposes only.

Paid participants will have an opportunity to submit questions specific to their business beforehand. Additionally, there will be three Q&A breaks during the webinar. The webinar will be recorded for paid registrants to review and listen at their leisure. Copies of the FAQs (with responses) will be emailed to each participant within two business days of the webinar.

Paid participants will have an opportunity to submit questions specific to their business beforehand. Additionally, there will be three Q&A breaks during the webinar. The webinar will be recorded for paid registrants to review and listen at their leisure. Copies of the FAQs (with responses) will be emailed to each participant within two business days of the webinar.